Investors deceived?

The big blender’s last million-euro trick

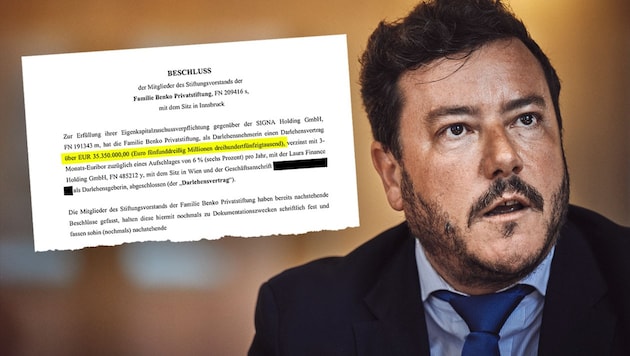

In the summer of 2023, René Benko withdrew a considerable 35 million euros from his financially ailing Signa Group in order to send it around the world and reinvest it in the holding company as supposedly "fresh capital" via his foundation. Has the financial juggler deceived his investors?

In the summer of 2023, all hell has long since broken loose in René Benko's group of companies. The European Central Bank (ECB) is investigating the banks that have lent to the Signa Group. There is a fire. In financial terms. Money is missing from every corner of the opaque network.

Cloaking and deceit

The financial juggler urgently needs fresh capital to restore the liquidity of his Signa Holding, which is already squeezed like a tube of toothpaste. And what is René Benko doing? He pretends to set a good example and provide the parent company of the Signa Group with fresh money from his family foundation. In the hope that the irritated and emotional co-investors around the German Fressnapf founder Torsten Toeller or the Swiss chocolate baron Ernst Tanner will once again join in. To "create new liquidity reserves" and to regain "access to attractive financing options", according to an internal memo obtained by "Krone" and "News". A capital increase by all shareholders of Signa Holding is intended to avert the collapse of the already dangerously shaky house of cards at the last minute.

In July 2023, some of Benko's co-owners were actually persuaded one last time to inject more money into the faltering Signa Holding. A total of 350 million euros is planned. Benko promises that ten percent of this sum, 35 million euros, will come from his family foundation in the form of fresh capital. The problem is that the foundation will no longer have the liquidity to raise this amount in summer 2023.

What to do? The oldest sleight-of-hand trick, which has probably been used by tight financial jugglers since the invention of money, follows: the hole-on-hole trick. Joint investigations by "Krone" and "News" have followed the money trail. They uncovered an almost breathtaking circular transfer that allegedly turned a loan from a Signa subsidiary into fresh equity for the Signa parent company practically overnight.

35 million euros flow from

An urgently needed sum of 35 million euros is withdrawn from a subsidiary of Signa Holding at the end of June 2023. Reason for transfer: a loan for another Benko company. The 35 million euros are sent on their way via several accounts and companies: First to a subsidiary of Benko's Laura Private Foundation. From there - also as an alleged loan - to the Benko family private foundation, which holds ten percent of the shares in Signa Holding. In the capital increase of 350 million euros that Benko has once again begged from his investors, the Benko family private foundation must set a good example and pay its promised share: just that 35 million euros.

The foundation pays back the 35 million

According to confidential documents, the Benko family private foundation only had a few hundred thousand euros of cash left in its accounts at the end of 2022. It therefore urgently needed the 35 million loan in order to be able to fulfill Benko's promise to provide Signa Holding with 35 million euros in capital. In Benko's foundation, the money that originally came from the Signa Group is therefore labeled "fresh equity" and made available to Signa Holding as the ultimate parent company. In other words, the parent company of the group, from whose subsidiary it had previously been withdrawn via various loan agreements in a circular transfer through Benko's non-transparent corporate network.

This sleight of hand in his corporate realm of darkness was probably René Benko's last desperate attempt to publicly signal to potential investors and capital providers that he still enjoys the trust of his existing investors. In fact, he has made his Signa Holding partners bleed one last time with this 350 million capital increase.

The Benko confidants involved

Incidentally, the official loan agreements for this highly dubious carousel of money were only signed weeks after the circular transfer, specifically on August 16 and 17, 2023. They were signed by Benko's closest confidants: the holding company managing directors Christoph Stadlhuber and Marcus "Unterschriftenaugust" Mühlberger. In the middle of it all: Signa CFO Manuel Pirolt, who conveniently also sits on one of the foundations. Like Mühlberger in the other, alongside Benko's long-standing tax advisor from TPA, Karin Fuhrmann. According to research by "Krone" and "News", René Benko was involved in the transactions.

Although some of the Signa investors, unlike Benko's foundation, actually brought in fresh millions in July 2023, Signa Holding could no longer be saved. The holes were already too big and could no longer be plugged: just a few months after Benko's publicly celebrated 350 million capital increase, the first Signa insolvency marked the beginning of the demystification of the big racketeer and blender.

Kommentare

Liebe Leserin, lieber Leser,

die Kommentarfunktion steht Ihnen ab 6 Uhr wieder wie gewohnt zur Verfügung.

Mit freundlichen Grüßen

das krone.at-Team

User-Beiträge geben nicht notwendigerweise die Meinung des Betreibers/der Redaktion bzw. von Krone Multimedia (KMM) wieder. In diesem Sinne distanziert sich die Redaktion/der Betreiber von den Inhalten in diesem Diskussionsforum. KMM behält sich insbesondere vor, gegen geltendes Recht verstoßende, den guten Sitten oder der Netiquette widersprechende bzw. dem Ansehen von KMM zuwiderlaufende Beiträge zu löschen, diesbezüglichen Schadenersatz gegenüber dem betreffenden User geltend zu machen, die Nutzer-Daten zu Zwecken der Rechtsverfolgung zu verwenden und strafrechtlich relevante Beiträge zur Anzeige zu bringen (siehe auch AGB). Hier können Sie das Community-Team via unserer Melde- und Abhilfestelle kontaktieren.